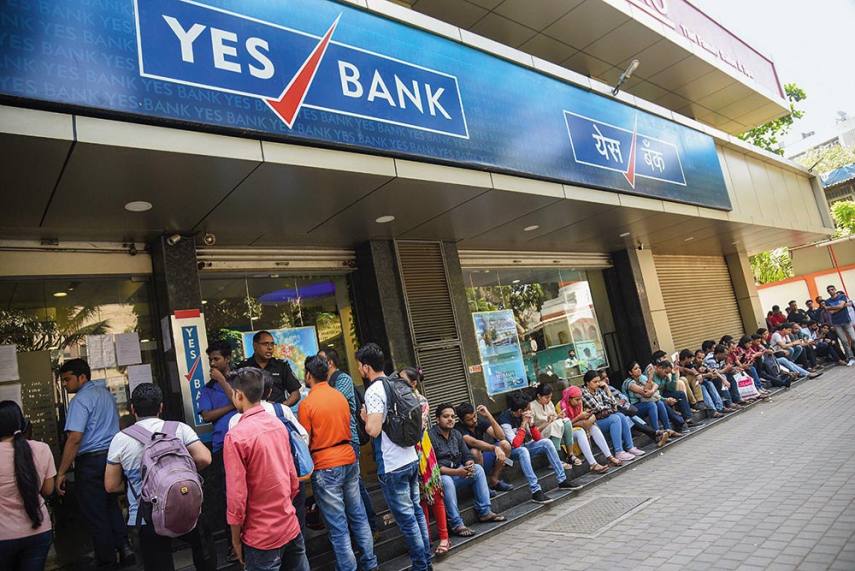

TNB, March 20, New Delhi. The confidence of depositors has been severely jolted after the Reserve Bank of India no-balled the Yes Bank, the fifth largest bank of the country. On March 5, RBI had placed 30 days moratorium which restrict the withdrawal to 50 thousand for a month. The situation, it is feared, may turn to the worst once the RBI lifts the restriction of rupees 50 thousand.

In that case the depositor may gradually withdraw all the amounts as they already lost faith in Yes Bank. So, the experts are not very hopeful of the early revival of the Yes Bank. According to reports piling of bad debt lend to entities includes, Anil Ambani’s Reliance Group, Vodafone Idea, Subash Chandra’s ESSEL groups, DHLF, Infrastructure leasing and financial services was the primary cause of the trouble. Subhash Chandra is a BJP Member of Parliament in Rajya Sabha from Haryana.

Experts trace the roots of failure of banks to demonetisation, which dealt a serve a blow to manufacturing and service sectors. It broke the momentum of growth. Several industries which borrowed loans from the bank had failed because the overall scenario was not favorable for their growth. The demand plummeted drastically and the purchasing power of the people also fell. Note ban also rendered lakhs of people unemployed.